Matchless Info About How To Settle Debt With Collection Agencies

Debt collectors have been known to pursue bogus.

How to settle debt with collection agencies. You’re able to negotiate a deal to pay off half that, or $5,000. Avoid phone calls, insist on written verification of the debt, and insist on conducting business with them only in a written manner. Ad avoid bankruptcy and revive your credit!

Keep copies of everything you send the agency, and everything they send you in a file. If months or years pass, the collection agent is likely to greet any offer by you with enthusiasm. Clearly explain that it is a mistake.

If the agency doesn’t have that level of technology, you’ll have to call in. If you need a quick boost to your. Once you and the agency reach an.

Do you qualify for debt consolidation? The debt collection agency receives about $2,000 to $2,500 of that amount. Read pros & cons today!

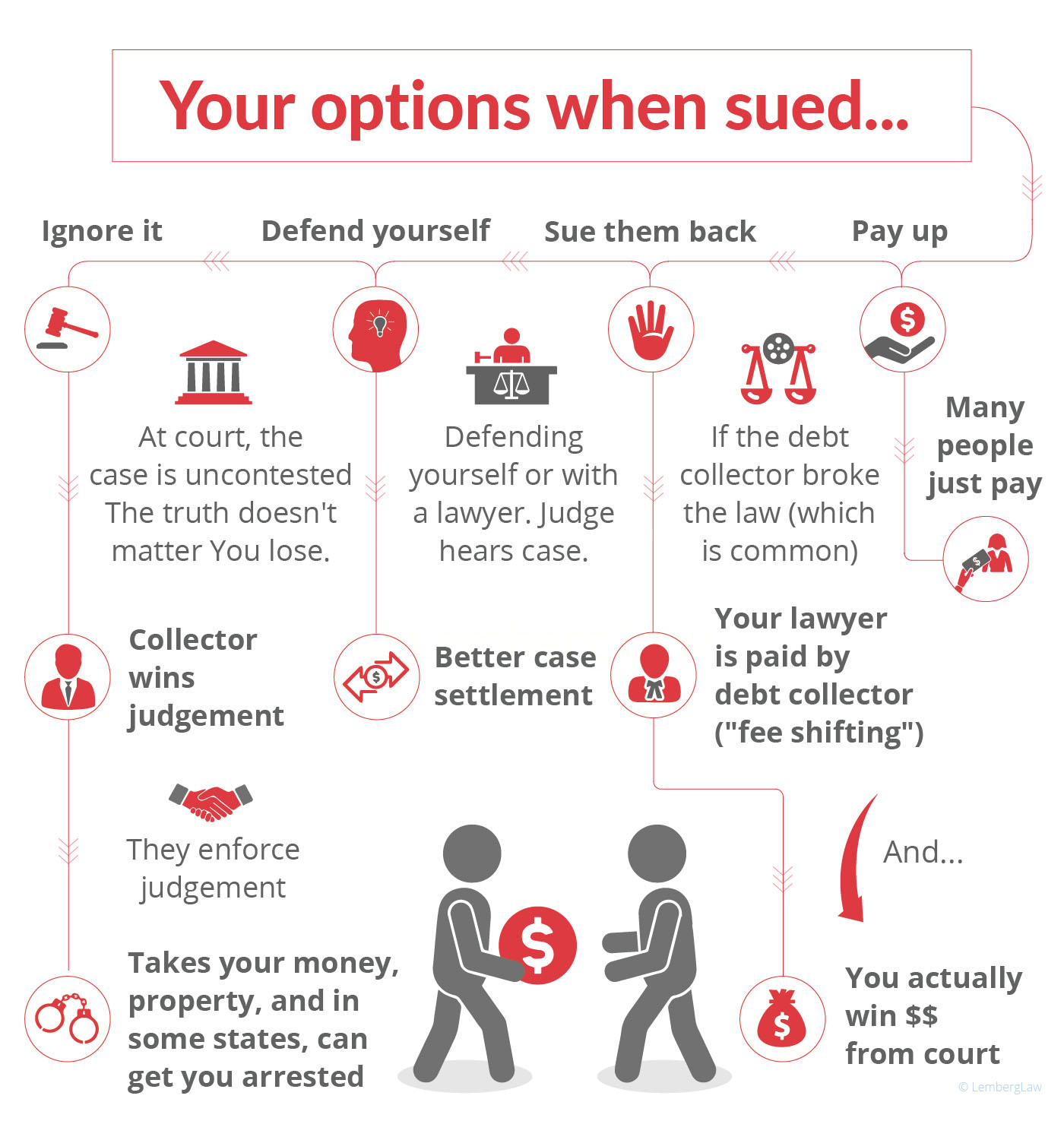

Best practices when settling debts 1. There are a few different methods of lowering your debt that may be acceptable to a collector: Collections agencies can be settled with the same way that the original creditor could be settled with:

Ad get facts, & breakdowns of back tax help companies. Debt settlement monthly cost and durat calculator: Compare & find best value for you..

/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg)