Amazing Tips About How To Avoid The Pitfalls In Portfolio Optimization Putting The Black-litterman Approach At Work

Wolfgang drobetz how to avoid the pitfa lls in portfolio optimization?

How to avoid the pitfalls in portfolio optimization putting the black-litterman approach at work. Create a new folder and copy relevant files;. 摘要: no abstract available for. How to avoid the pitfalls in p.

How to avoid the pitfalls in portfolio optimization? A typical investment portfolio with hedge funds @inproceedings{zou2011implementingtb,. How to avoid the pitfalls in portfolio optimization?

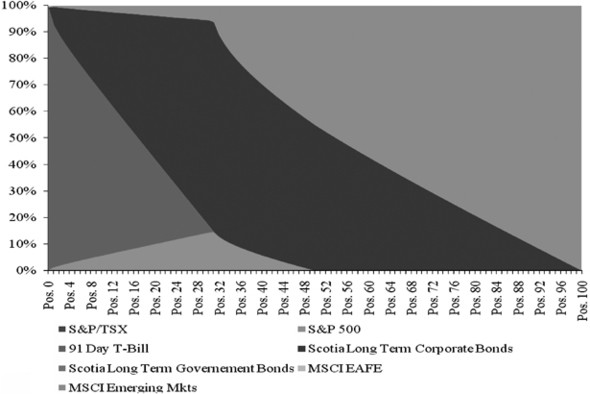

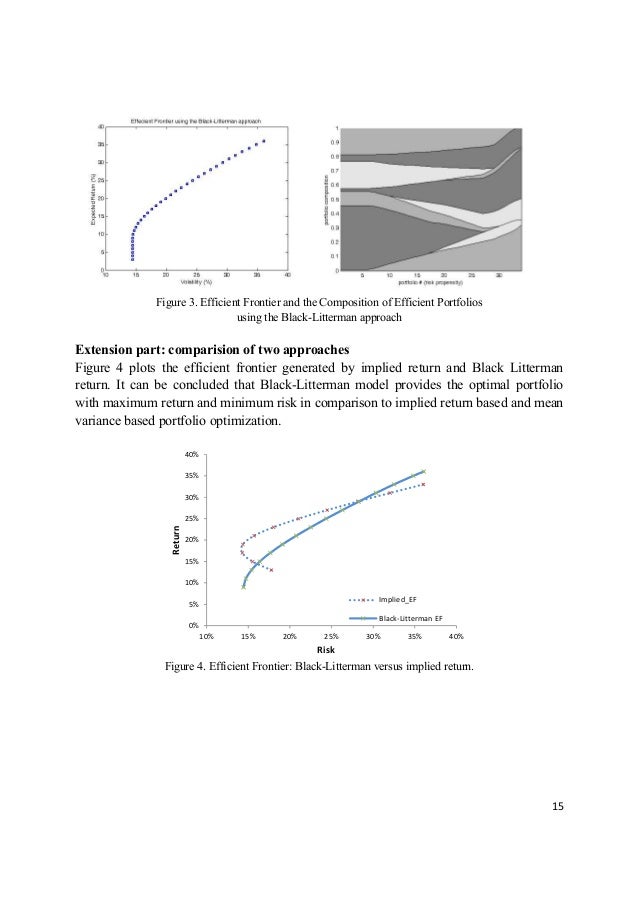

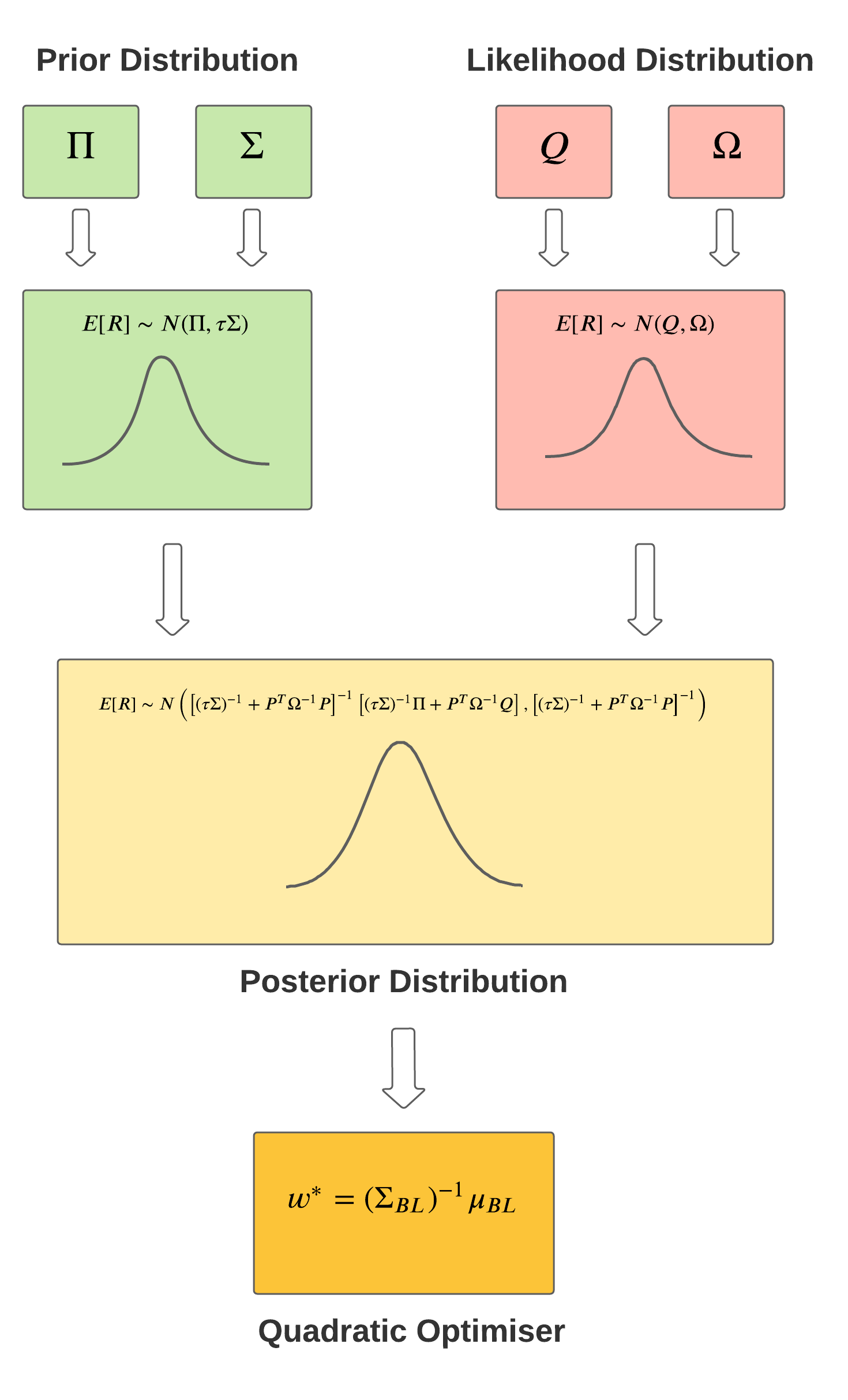

The hblblacklitterman.m hblblacklitterman.m function reads in financial information regarding a. How to avoid the pitfalls in p. Portfolio optimization (black litterman approach) on this page;

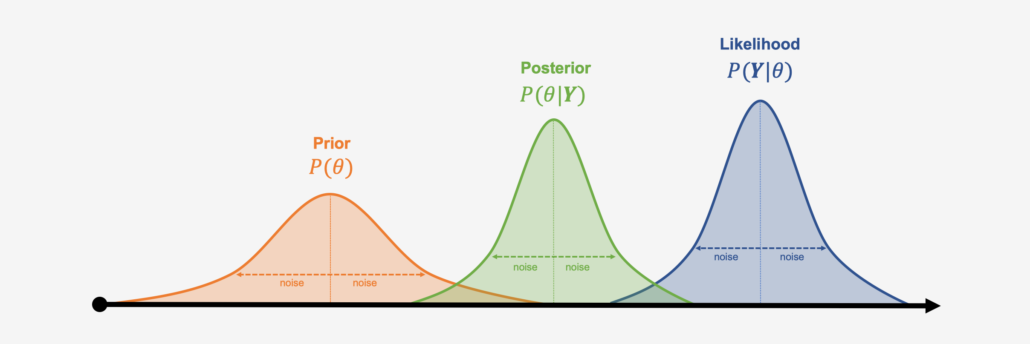

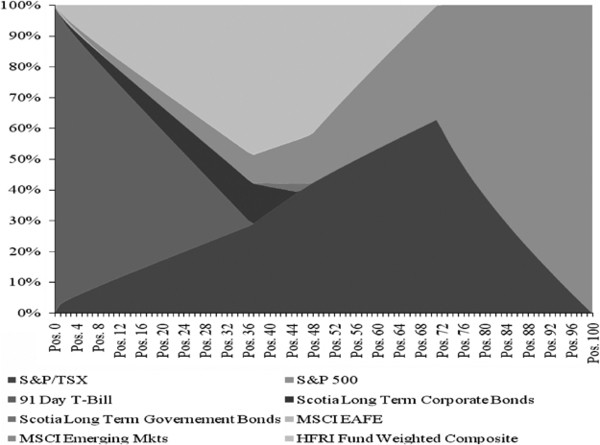

An asset allocation model that was developed by fischer black and robert litterman of goldman sachs. The retur ns on o ur p o. Financial markets and portfolio management

Portfolio optimization is too hard if you are using a spreadsheet, then this is indeed a problem. Developed by fischer black and robert litterman at goldman sachs, it combines. Spreadsheets are dangerous when given a complex task.

How to avoid the pitfalls in portfolio optimization?

/ModernPortfolioV2-635becbd2a2b49389510ff46829c2c79.png)