Inspirating Tips About How To Reduce Social Security Taxation

Withdrawals from a traditional ira are included in income and fully taxable.

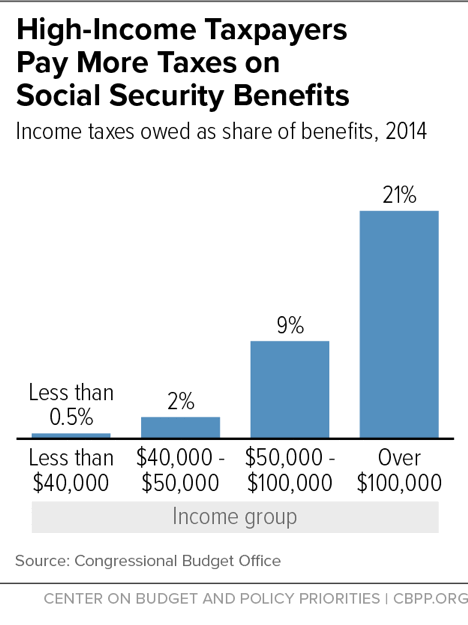

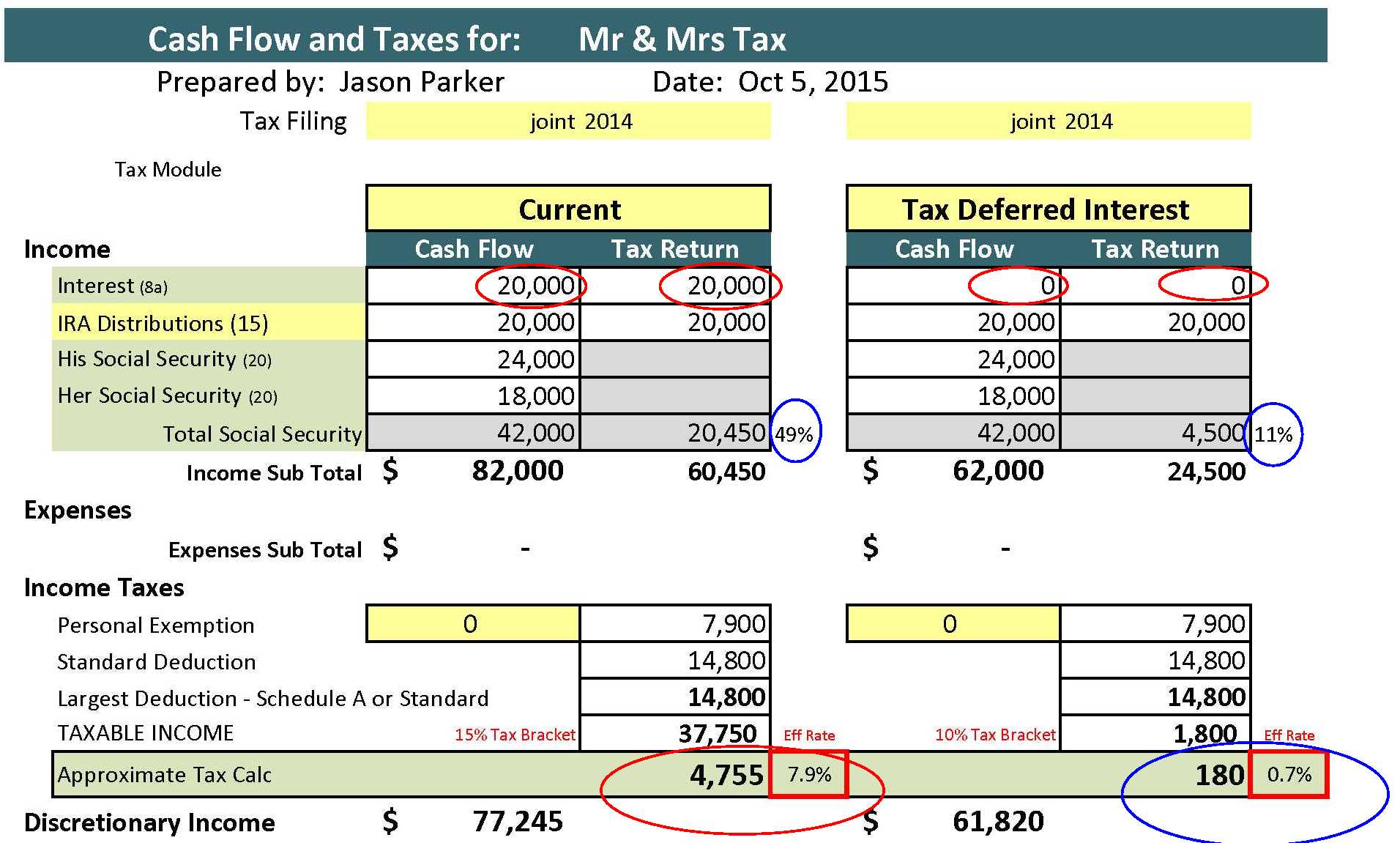

How to reduce social security taxation. Stay below the taxable thresholds. As much as 85% of. Most retirees are looking to pull money from their iras rather than put it.

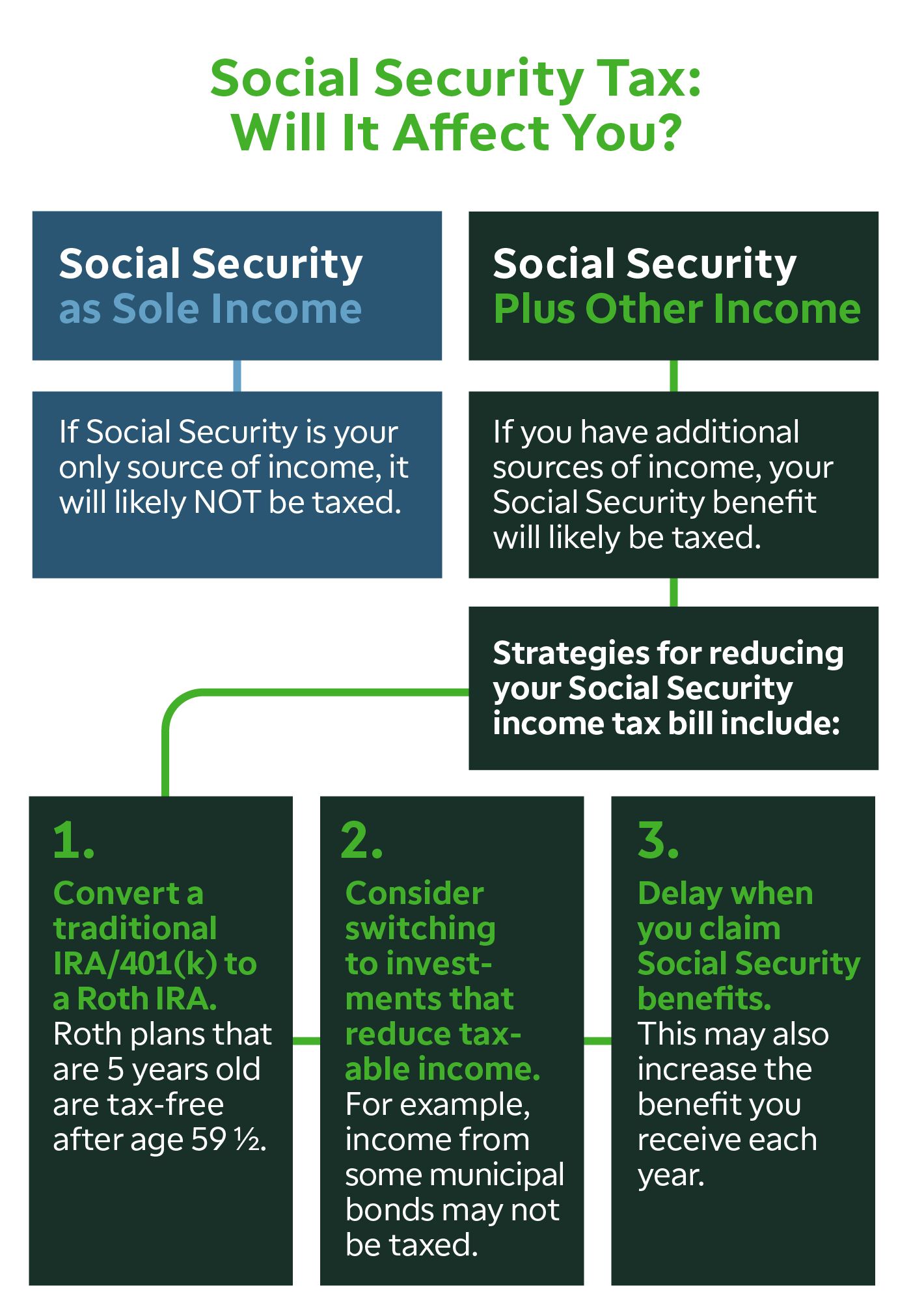

A good first step is to start planning ahead — including thinking about the income sources you can. Now that you know some of the basics of social security benefits taxation, the next step is to learn how to reduce or even eliminate these taxes. See these tips on how to reduce those potential taxes.

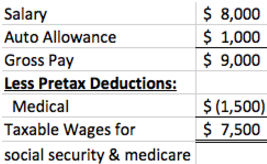

The resulting tax advantage from lower retirement account balances when rmds begin is to lower adjusted gross income (agi) and therefore taxation. Strategy #1) strategically organize your. Only the first $142,800 of a worker’s earnings is subject to the 12.4% in social security taxes.

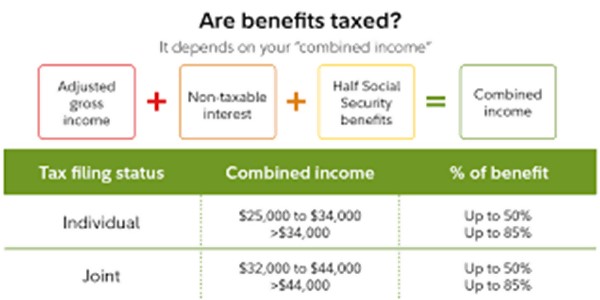

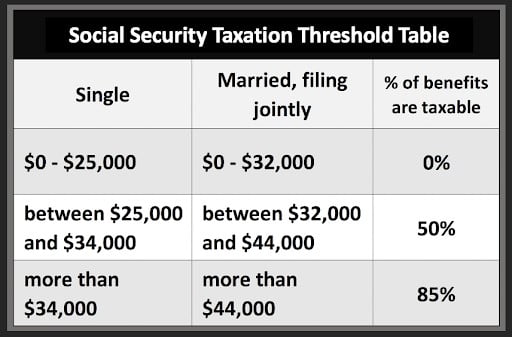

How to reduce or eliminate taxes on social security benefits! 1 day agoa 2021 bill that polis signed allows people 65 and older to deduct all of their social security income from their colorado taxable income beyond the previous limit of $24,000. File a federal tax return as an individual and your combined income* is between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

First, let's address the roth ira. Every dollar after that gets off scott free. That rises to $32,000 if you’re married and filing a joint return.

3 ways to avoid taxes on benefits place some retirement income in roth accounts. If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement benefits. If that number is above $25,000, you’ll have to pay some tax if you.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)