Casual Info About How To Build Credit With A Secured Credit Card

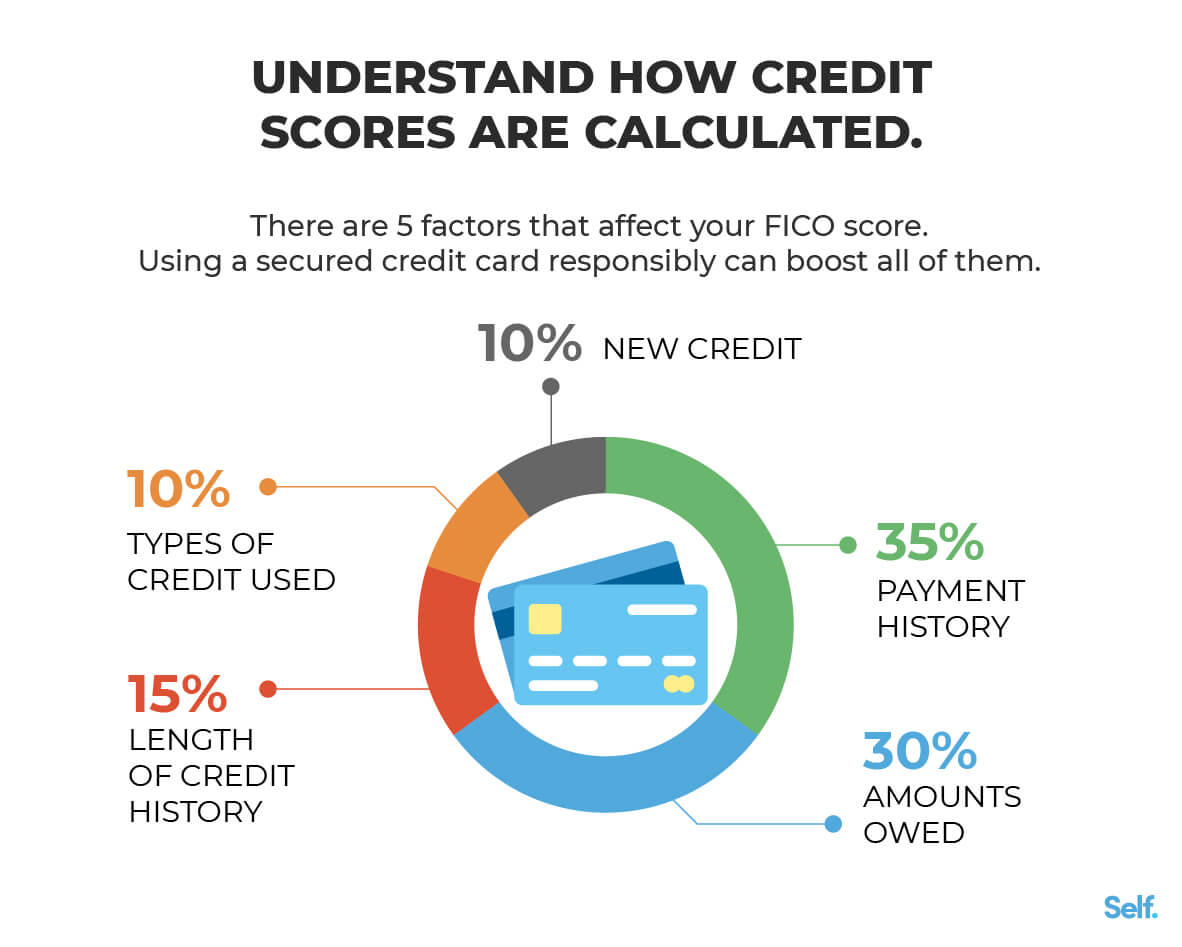

Self will help establish the regular payment history that is key to building credit

How to build credit with a secured credit card. 5 tips for secured credit card success. Get a secured credit card. #buildingcredit #creditcards #creditbuilding 1 easy way to start building your credit 1 easy way to start building your credit1.

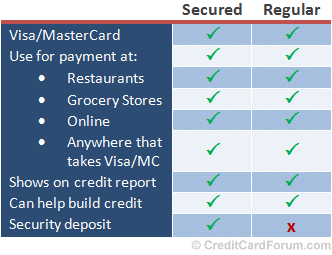

The lender may request that you secure the credit line partially or fully with a deposit. Choose the right card for you. It can help you build credit.

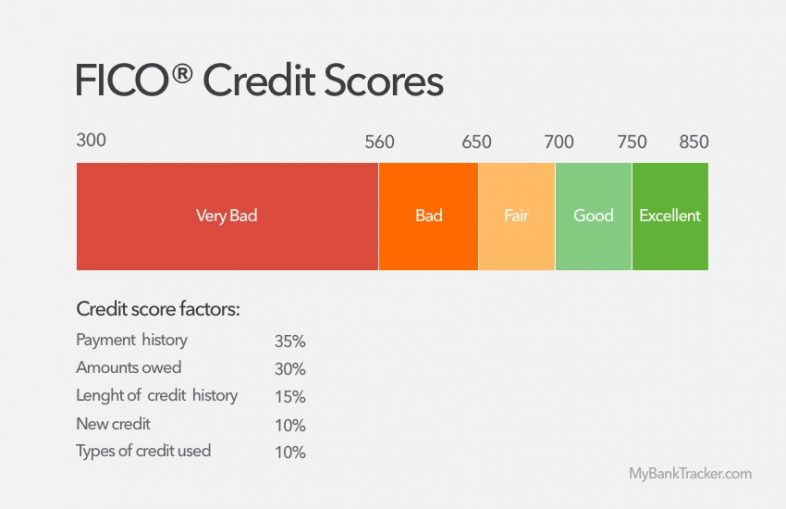

Assuming you pay your bill on time each month and prove yourself to be a. Ad pick a plan & pay monthly to build credit history. Sending a cheque or money order.

Ad get access to the credit you need with a refundable secured card deposit—apply today. It’s important to know how the secured credit card company wants to receive the. 1.5% cash back on everything.

A secured credit card is a type of credit card that requires a security deposit or savings account collateral. Keep the following in mind: Choose the right secured card when shopping for a secured card, you'll want to.

The capital one quicksilver secured cash rewards credit card is the best credit card in this group for rebuilding credit because it pays. Don’t choose just any secured credit card. Besides payment history and credit utilization, other things factor into your credit score, such as:

:max_bytes(150000):strip_icc()/dotdash-secured-vs-student-credit-cards-which-to-choose-5190814-Final-78ffa1b9aa5d47028994ff6d47518a2b.jpg)